FINANCE & SUSTAINABILITY

What is the Relationship Between Sustainability and Finance?

Finance advances sustainability by analyzing and incorporating environmental, social, and governance factors into financial decisions and the understanding of capital markets, portfolio management and business valuation.

According to U.S. Securities and Exchange Commission (SEC), sustainable finance, also called environmental, social, and/or governance (ESG) finance, refers to investments that consider environmental, social, and/or governance factors. In response to investor demand, the SEC is “responding with an all-agency approach” to provide guidance and standards. The SEC details each of the ESG factors below:

- The environmental factor refers to “a company’s impact on the environment—for example, its energy use or pollution output. It also might focus on the risks and opportunities associated with the impacts of climate change on the company, its business, and its industry.”

- The social factor refers to “a company’s relationship with people and society—for example, issues that impact diversity and inclusion, human rights, specific faith-based issues, the health and safety of employees, customers, and consumers locally and/or globally, or whether the company invests in its community, as well as how such issues are addressed by other companies in a supply chain.”

- The governance factor refers to “issues such as how the company is run—for example, transparency and reporting, ethics, compliance, shareholder rights, and the composition and role of the board of directors.”

Video: ESG Investing on Office Hours with

Gary Gensler, Chair, U.S. Securities and Exchange Commission

On the corporate side of sustainable finance, businesses find value in considering ESG criteria along with traditional financial criteria when making capital allocation decisions such as in project valuation and net present value (NPV) calculations–including emerging tools such as sustainability net present value (SNPV).

On the investing side, investors use ESG information to develop a more accurate risk profile of alternative investments or to compare asset classes. Businesses communicate ESG information to investors via traditional reports (e.g., 10K and 10Q) as well as integrated and sustainability reports.

Why Sustainability Needs Finance

According to a Harvard Business Review article on the “investor revolution” in ESG finance, the importance of incorporating sustainability is being driven by many factors:

- Financial returns: Research shows that firms with better ESG records may experience higher returns.

- Growing demand: Asset owners, who are looking to make a difference and experience higher returns, are in the market for a choice of investment strategy that focuses on sustainability.

- Fiduciary duty view: Traditional fiduciary duty definitions obligate investors to consider financial returns only, but more recently, these definitions are including ESG factors that could affect financial returns in those obligations. This represents a massive shift underway, from focusing exclusively on stakeholders to a broader focus on shareholders.

- Trickle-down effect: As ESG investing saturates the market and demand outstrips the availability of credible ESG opportunities, corporate executives will be driven to care more about sustainability to position themselves for the responsible investor.

- ESG activism: Institutional retail investors and shareholder activists are increasingly advocating for ESG, calling for everything from climate action to greater attention to diversity, equity, and inclusion (Columbia Law School).

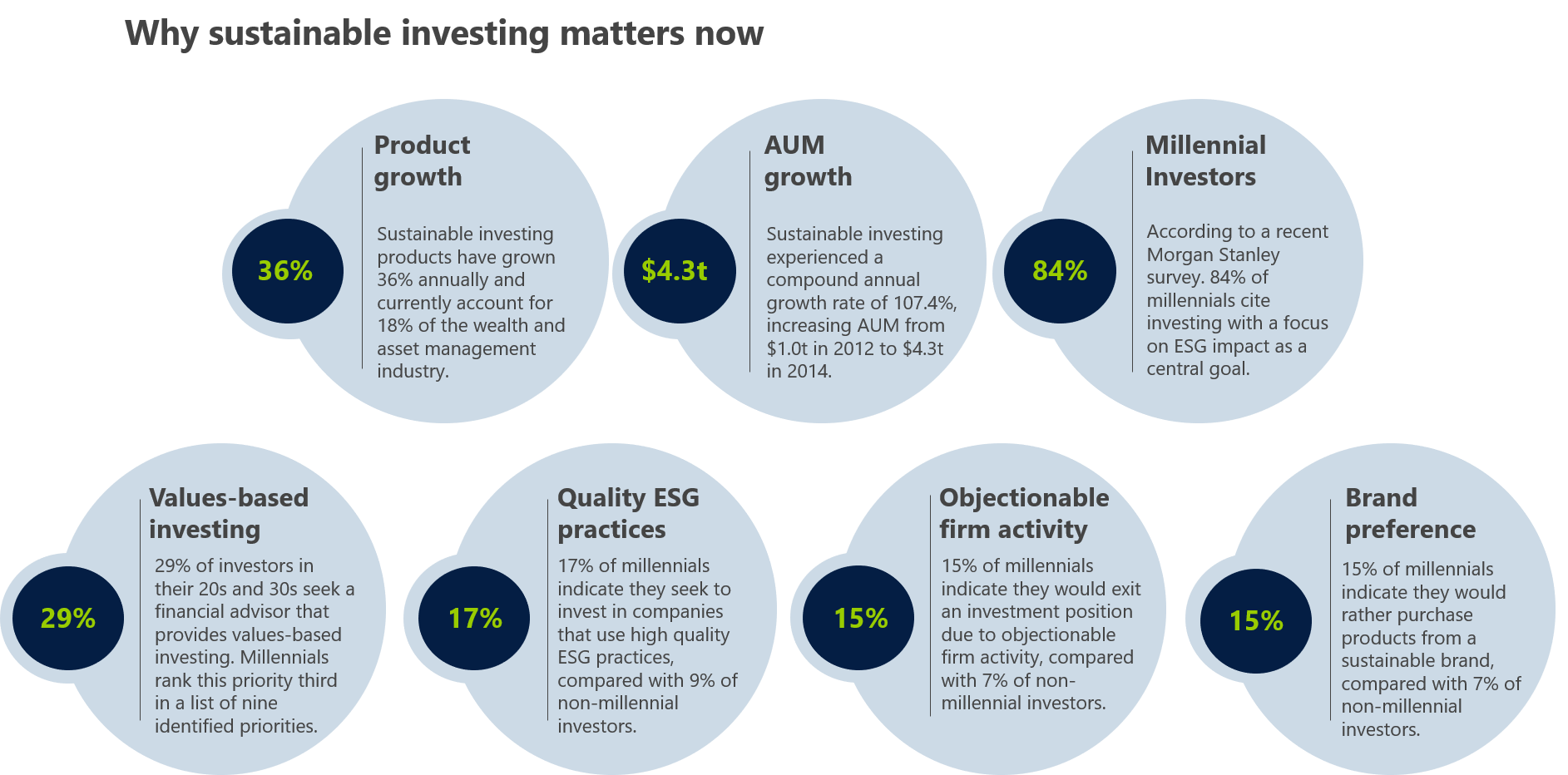

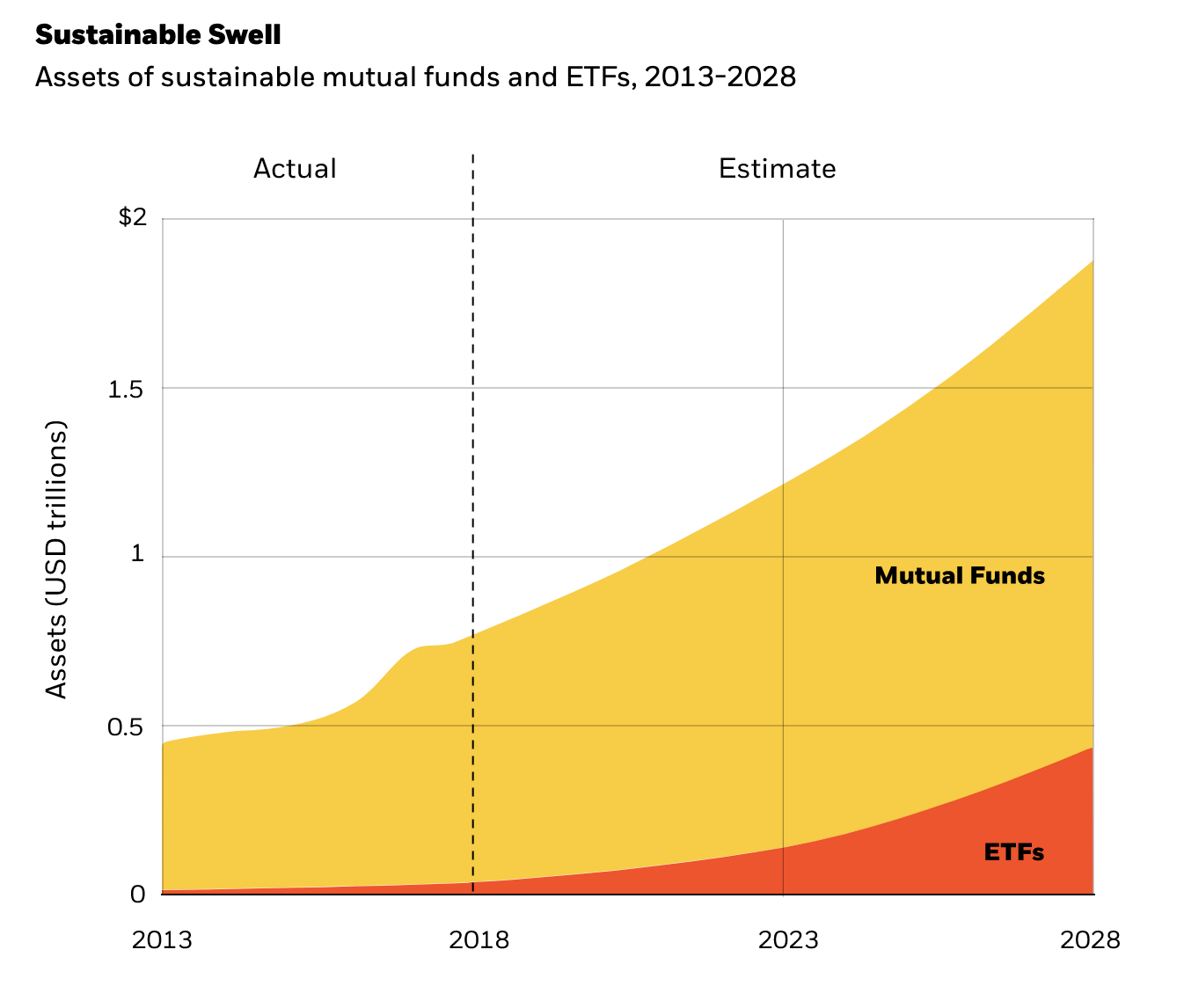

An Expanding Opportunity: BlackRock Shows Growth of Sustainble Investing

Millenials Driving ESG Growth