RISK MANAGEMENT & SUSTAINABILITY

What is the Relationship Between Sustainability and Risk Management?

Risk Management advances sustainability by identifying, analyzing, and minimizing social and environmental risk while promoting resiliency.

Risk management has increased in prominence and in its level of analytical sophistication as the marketplace has become more global, interconnected, and scrutinized by regulators and a more demanding public and investor community. In short, recognizing and managing risks is more critical than ever for business success.

However, traditional risk management has actually not recognized many of the most critical business and societal risks. The conventional focus on short-term financial, strategic, and operational risks has often excluded “externalities” that have compounded and become risks and, in some cases, crises. Climate change to water scarcity to energy security to forced migrations now pose significant threats to business–and society.

What is needed now is sustainable risk management which includes the near and long-term social and environmental risks of the enterprise and its suppliers, buyers, even its own investments.

Fortunately, we have the powerful tools of traditional risk management. These tools, upgraded and repurposed for today’s grand challenges, can be used to recognize and better respond to the emerging, complex risks captured well by the Sustainable Development Goals (SDGs).

Choose Your Path: Enterprise Risk Management and Real Estate

At the Smeal College of Business, Risk Management majors choose between one of two options: Enterprise Risk Management and Real Estate. From a sustainability perspective, each of these important areas play a critical role in meeting the Sustainable Development Goals (SDGs) and improving a company’s environmental, social and governance (ESG) performance.

If you are visiting this site from another business school, the way risk management is organized could be different. However it shows up, these pages will be helpful to understand how Risk Management contributes to corporate sustainability performance and the Sustainable Development Goals (SDGs).

- Enterprise Risk Management can improve a company’s ability to recognize social and environmental risks and opportunities, especially in the supply chain where 80% of ESG issues reside (McKinsey)

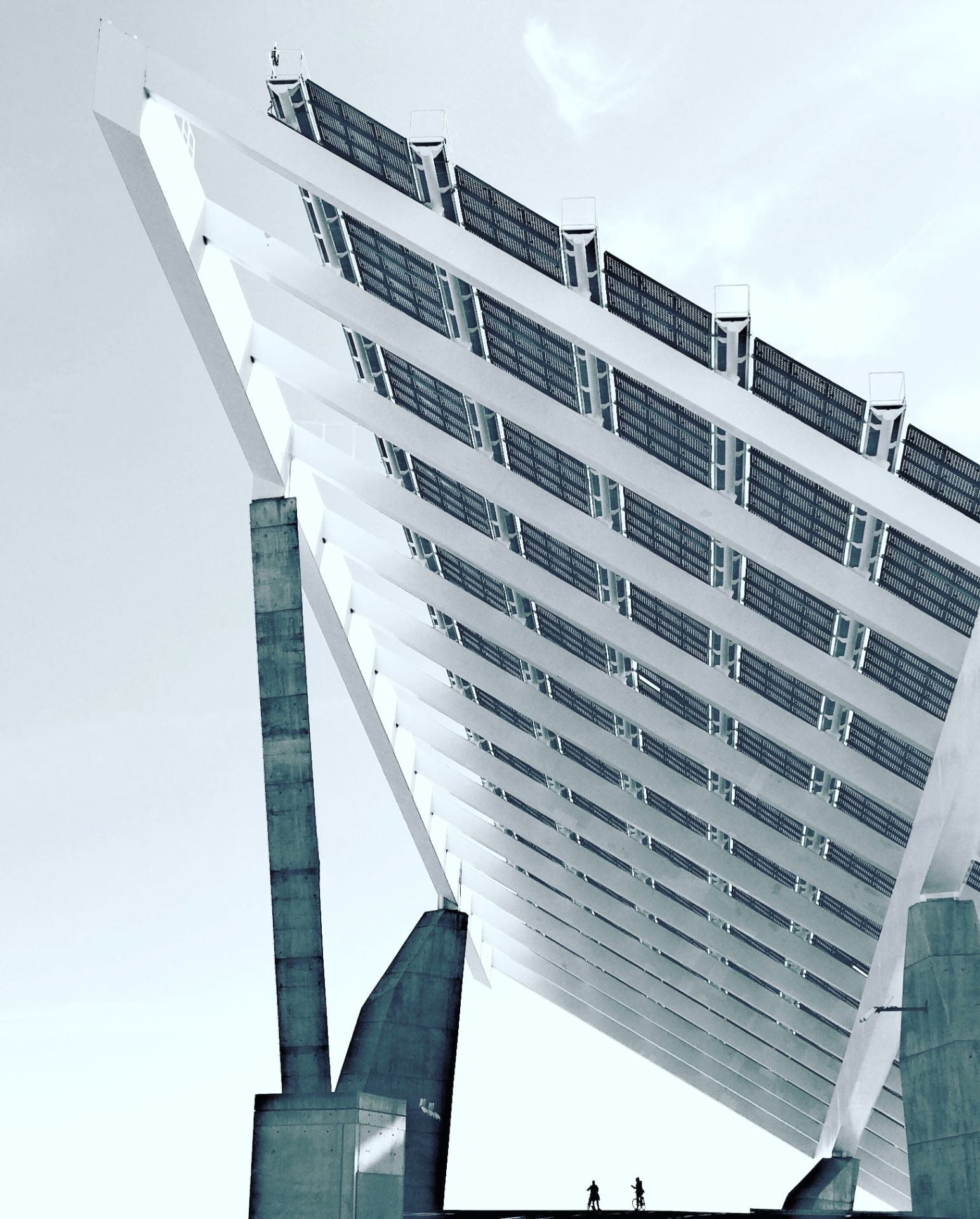

- Real Estate plays a major role in advancing sustainability also considering that 75% of infrastructure needed by 2050 hasn’t been built and today buildings contribute 30% of the world’s greenhouse gas emissions (Harvard TH Chan School of Public Health)

Real Estate Option focuses on assessing and managing risks and opportunities particular to real estate and property management.

Enterprise Risk Management (ERM) Option focuses on assessing and managing strategic, financial, hazard, and operational risks.

Sustainability and Enterprise Risk Management

Enterprise Risk Management (ERM) is a business function used to build value by identifying and managing risks. According to the Society of Actuaries, sustainable ERM is “the management of ESG issues for the purpose of stakeholders’ shared value creation to realize sustainable development of the firm and the society it operates in.” Climate risk assessment is a good example of the kind of analysis done by SERM.

Until recently, sustainability and risk management have been separate departments or functions in a corporation that rarely interacted. However, for leading companies, these two areas work closely together. Risk managers tend to be better at identifying near-term, traditional sources of risk. Sustainability professionals tend to excel at identifying emerging non-traditional risks.

On how risk and sustainability need one another, Risk Management Magazine, states: “Risk disclosures can be biased toward focusing on the issues the company can directly mitigate; sustainability disclosures can come off as marketing exercises that feature happy children and questionable data. The current divide is in no one’s interest, and global changes are forcing both parties and organizational management to rethink their approach.”

Why Sustainability Needs Enterprise Risk Management

Sustainable ERM can identify risks and issues in a way that gives us more time to create solutions. It continues to help throughout the process by then pinpointing potential risks in the solutions to these problems. Perhaps one of the most important aspects of sustainable ERM is that through the management of risks, it can lead to recognition of new business opportunities.

An excellent example that demonstrates the “why” of SERM is Kering’s work to create the world’s first Environmental Profit and Loss (EP&L) which helped them in 2010 uncover EUR 145 million in social and environmental risks they had never accounted for.

The benefits of sustainable ERM include:

-

- Improved ability to identify risks and issues in the field that may have otherwise been considered unpredictable or unforeseen

- Stronger business case for sustainability/ESG given the data-driven analysis of material risks provided through ERM

- Quicker response time to emerging issues through operational changes and communications with stakeholders (employees, community, investors, etc.)

Sustainability and Real Estate

Real estate is a subset of risk management that is focused on the financial, legal, and unique property management challenges in the real estate market. It includes a wide range of professional opportunities in corporate real estate, commercial real estate brokerage, appraisal, risk management, mortgage lending and banking.

Real estate plays a huge role in sustainability. According to the International Energy Agency buildings consume 40% of the world’s energy and produce 30% of the world’s greenhouse gas emissions. The agency goes on to say that to meet global climate targets “all new buildings and 20% of the existing building stock would need to be zero-carbon-ready as soon as 2030”. Moreover, people spend 90% of their time indoors the air quality of which plays a fundamental role in public health. Finally, the access to safe, affordable housing is a critical social safety net for human society. Pew Research suggests 49% of Americans consider “the availability of affordable housing a major problem.” Clearly meeting these housing challenges includes but also goes beyond existing frameworks such as US Green Building Council’s Leadership in Energy and Environmental Design (LEED) Program.

In short, real estate majors and professionals can play a critical role in meeting the Sustainable Development Goals (SDGs). This major is one that has some of the greatest ability to impact not only the environmental aspects of sustainability/ESG, but also social and economic equity components as well.

Sustainable real estate can ensure that social and environmental impact are optimized throughout the real estate development, financing and management process. Professionals will be knowledgeable of these opportunities and emerging platforms like GRESB that provides ESG data to real estate investors and managers.

Why Sustainability Needs Real Estate

Sustainable real estate is important because of the large impact the built environment has on the planet and human communities–and because investors, tenants, regulators, and other key stakeholders are increasingly requiring it.

Sustainable real estate development and investment, when approached correctly and with the proper level of careful analysis, can have a number of financial, social and environmental benefits.

Sustainable real estate makes financial sense. According to the UN Environment Program’s report Sustainable Real Estate Investment and World Economic Forum’s Environmental Sustainability Principles for the Real Estate Industry:

- New buildings can be designed “to use 30-50% less energy than required by most 2005 energy codes”

- A range of studies suggest 4 – 18% higher occupancy rates for sustainable buildings

- Similar studies show a rent and price premiums of 4 – 10%

- Lower costs of capital since such buildings are more popular and less expensive to operate

Sustainable real estate is also better for people. These same reports suggest:

- The benefits of improved indoor air quality and

healthier workplaces are “estimated to be worth US$17-30bn a year, with additional savings of US$20-60bn from improved employee productivity” - Affordable housing increases local spending power, increases tax revenues, and ensures safer, more cohesive communities (Forbes)

Finally, the environmental and climate benefits can be enormous. UN and WEF reports explain:

- Raw material, water and energy consumption can be cut from 12 – 30% or more

- Solid waste generation and diversion can be cut by 40%, and zero waste buildings are becoming common