FINANCE & SUSTAINABILITY

Sustainable Investing

According to US Securities and Exchange Commission (SEC), sustainable finance, also called ESG finance, refers to investments that consider environmental, social, and/or governance factors. Investors that engage with sustainable investing tend to invest through the lens of financial return + social return = total return.

There are many different approaches to sustainable investing. The most commonly used sustainable investment strategies include: negative screening, positive screening, ESG integration, impact investing, and more.

Below is a brief introduction of each of the main types of sustainable investing approaches. To read more about how sustainable and ESG investing evolved check out this timeline from the CFA Institute’s The Rise of ESG Investing.

The Six Main Types of Sustainable Investing

The information provided below comes from the work of the Summit Consulting report “Environmental, Social and Governance (ESG) Investment Tools: A Review of the Current Field” (2017). The examples given should not be understood as investment advice or the preferences of the site authors but are provided only so the reader has something concrete that illustrates the concept.

Negative screening

Investments are determined by what undesirable social and/or environmental outcomes the investor wants to exclude. Exclusion criteria can be include product categories (e.g. weapons, tobacco), activities (e.g. animal testing) or practices (e.g. labor rights violations, corruption).

Example: The Change Finance U.S. Large Cap Fossil Fuel Free ETF

Positive screening

Rather than determing investments based on what you DON’T want (negative screening), positive screening selects investments based on what you DO want. Relative to industry peers, investments are selected based on prioritized ESG factors and desired social and/or environmental outcomes.

Example: Harlem Capital Partners

ESG Integration

The inclusion of ESG risks and opportunities into traditional financial analysis and investment decisions. ESG outcomes don’t determine outcomes (like in Positive Screening or Impact Investing) but ESG data and analysis is part of the due diligence process.

Impact Investing

The generation of positive social and environmental outcomes is what drives this approach to sustainable finance. Financial returns are required but there is greater acceptance of below market returns as long as the desired impact is perceived to be realized.

Example: W.K. Kellogg Foundation’s Mission Driven Investment (MDI)

Thematic and Index Based

The construction of a portfolio of investments to match an impact theme (e.g. gender equity, clean water) or an established indices, such as MSCI or the Dow Jones Sustainability Index, that provides rankings and ratings of environmentally and socially responsible companies.

Corporate engagement and activism

The direct engagement of corporations through work to influence and encourage the board of directors to adopt sustainability/ESG practices. This includes the work of shareholder activists whose proposals and petitions pushing for work on climate change, diversity and labor rights protections has been on the rise (Harvard Law School).

Example: Engine N0. 1 and Exxon

The Rise of Sustainable Investing

According to the Forum for Sustainable and Responsible Investment (USSIF), sustainable investing is involved in one out of every three dollars that is professionally invested in the U.S. This equates to around $17 trillion in total assets invested using sustainable investing principles.

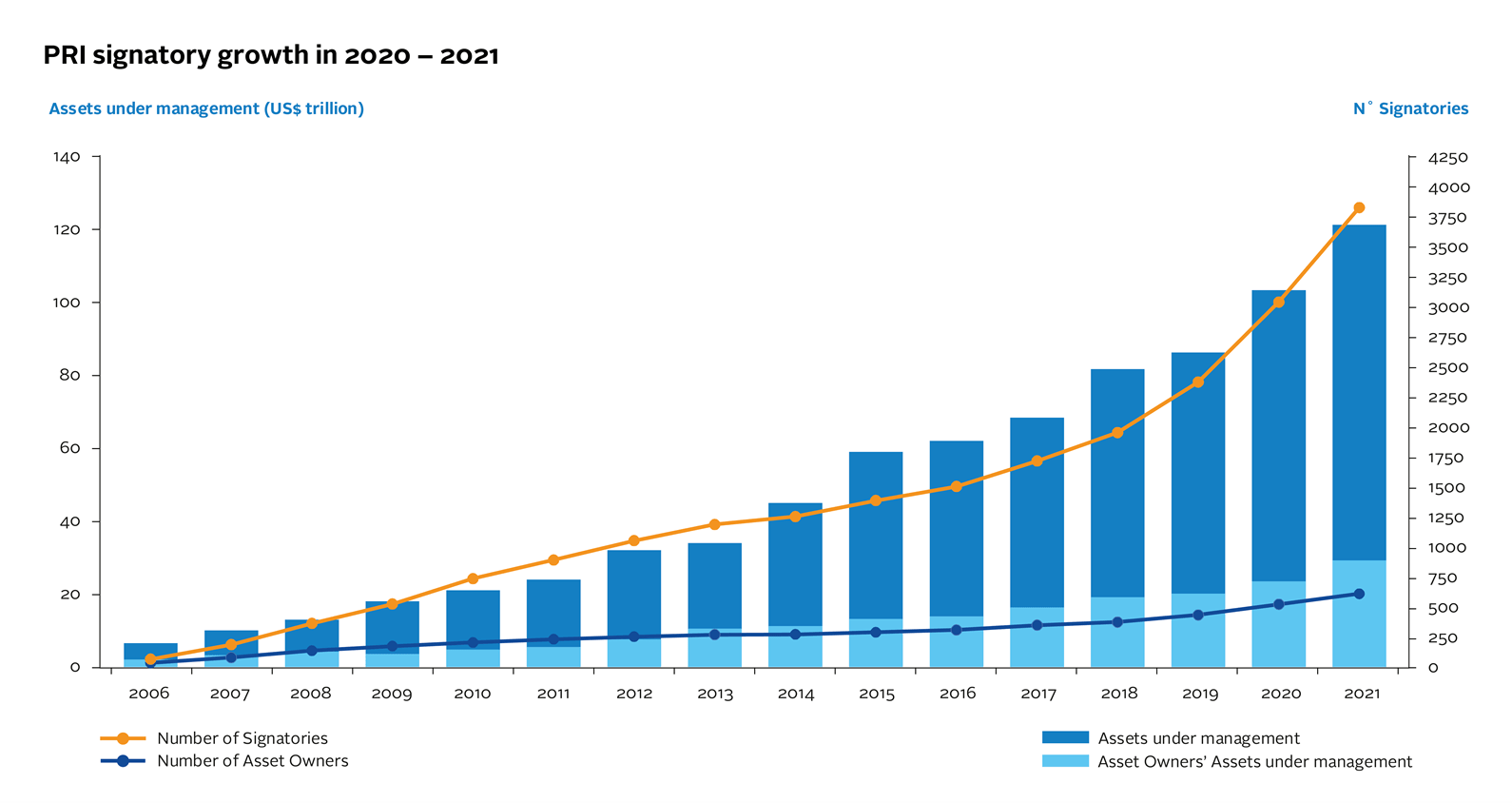

Globally, nearly 5,000 investment managers, asset owners, financial services providers are Principles for Responsible Investment (PRI) signatories (what are they signing onto?).

Finally, the wise finance student and professional recognizes that the rise of sustainable/ESG investing faces criticism around the quality of data, trustworthiness of claims of impact, and an overall sense that ESG investing perhaps wasn’t even “designed to save the planet” in the first place (Harvard Business Review).

Learn about more sustainability concepts within this major.